5 Key Reasons Accurate Unit Cost is Important

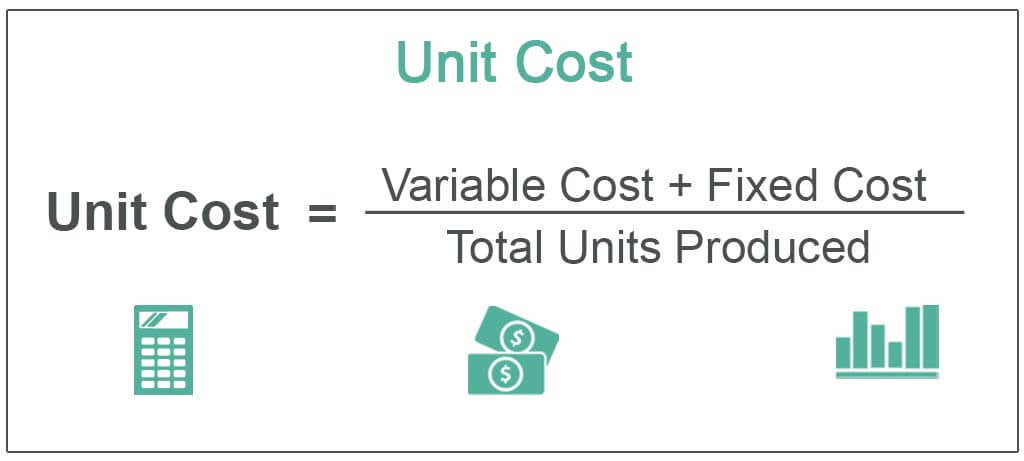

You may wonder if the above formula is sufficient to determine the unit cost e-commerce sellers should use in costing their products and in computing cost of goods sold.

I’ll tell you this, it’s not enough. Getting the total cost to produce your product or the purchase price (in case you buy it already made) divide by number of units produced or bought is an incomplete measure to determine the unit costs.

It’s because as e-commerce seller you need to add other costs directly related to bringing your product into the marketplace ready to be sold. Those include shipping fees from your supplier to your location, shipping costs from your location into Amazon warehouse or shipping cost from your own warehouse to Amazon warehouse. And other costs directly related to bringing your product to the marketplace like warehouse storage or fulfillment center storage costs.

But why would you bother making your unit costs more accurate when it asks for more work from you and your bookkeeper? Here are the top reasons why:

1. Accurate Gross Profit

While many people only looks at the top (Sales) and at the bottom (Net Income), analyzing your gross profit or gross margin (Middle) gives vital information to your revenue generation activities’ ability to sustain the business in the long run.

2. Profitability per product

Knowing how each of your products perform is key to optimizing your best products and removing or stopping the ones that are not bringing profit into the table.

3. Pricing Strategy

Your products’ unit cost is the amount that will be used to determine the optimal selling price. Without accurate unit cost – you maybe undercharging or overcharging your selling price.

4. Cost of Goods Sold

Accurate unit costs will be used to compute your cost of goods sold every month. Cost of Goods Sold is usually the largest amount of expense for product based businesses like e-commerce sellers. This figure is very important to get accurately.

5. Inventory valuation

Accurate unit cost is used to determine the ending inventory balance in your balance sheet every month or year-end (with physical count). The ending inventory balance is a balance sheet item that will show your remaining products not yet sold in a given ending date.

Aside from these important accounting points, knowing your unit costs can help you choose which supplier offers the best deal when sourcing your products. Unit cost involves the purchase price, shipping costs, and other costs related to bring it to the marketplace.